By J.R. Wilson

Military designers of RF microwave technology see analog integration as being an expensive proposition in the COTS world. However, designers are also looking at new packaging materials, new approaches to packaging, and new technologies to create more cost-effective products.

In the digital world, integration has tended to make things smaller, faster, lighter, and cheaper. In the RF (radio frequency) microwave and analog world, however, integration has often proven to be a poor choice because it would be more expensive than using discrete components.

Ron Reedy, chief technology officer at Peregrine Semiconductor in San Diego, says that while size and performance clearly have improved, in radio those improvements have come largely from better architectures and components, not integration, which has led the way in the digital world. Compared to those discrete solutions, integrated RF functions simply have shown an inferior price/performance ratio.

"So the new status quo is the old status quo," he says. "The portion of that failure to integrate that is technical in nature is fundamentally driven by the fact a radio is more about the passive components than the active (semiconductors, for example). There was a famous comment by a Motorola engineer, who said a radio contains 300 components, of which 290 are passive (resistors, crystals, capacitors) — things that have no transistors but still must be high quality.

"The problem with integration of RF is when you put passive devices onto normal semiconductor technology, the quality is degraded to the point they aren't very useful. So the fundamental issue with integration is how to deal with those 290 passives — or maybe 95 percent of them, maybe get it down to only 30 components. But to do that you have to get the vast majority integrated — you can't just eliminate their function."

That has led to some imprecise terminology, such as talking about integrating RF without setting a real definition of what that means. For example, a "single-chip radio" is actually one in which 10 transistors have been crammed onto one chip, reducing the number of total components from 300 to 290, "which doesn't solve the problem," Reedy maintains, because the number of discrete components in a modern radio remains virtually identical to those built in the days of vacuum tubes.

"This is generic across the board. You have to think of it as a passive integration problem, not a transistor integration problem," he says.

These difficulties have also led to a business climate that is somewhat similar to that of the microprocessor a few decades ago, a time in which companies with the size and power of Intel did not even exist. The citation is not entirely impersonal — Reedy likes to see 13-year-old Peregrine as the Intel of RF integration, seizing on a new technology to solve an old problem more established companies have not pursued.

Northrop Grumman's MMIC technology is used in various mission-critical applications.

null

"Why didn't IBM embrace the microprocessor?" he asks. "IBM had the most invested in the old method of buying components to put on boards to put in racks to put in cabinets. A new approach in the U.S. economic system tends to come from a small, new entrant rather than from the big, established players.

"It has to do with the business system more than technical decision making. It is fundamentally new, it has risk as well as reward and big companies, such as cellphone companies, concluded their interest lay in reducing the cost of existing solutions rather than finding a new solution. So it takes a company like Intel to be the innovator.

"We recognized this problem in the early 90s and felt we had a technical solution. By putting the passive components onto a sapphire substrate, we maintain the high quality factors required to yield a high quality radio. You can build these components on substrates like silicon, but that is a classic lossy material; the beauty of sapphire is it is lossless, which means we have the potential of reducing the 300 components by 90 percent. Now instead of going from 300 to 290, we can go to less than 30 components, with one single chip containing all the transistors and 90 percent of all the passive devices, as well. That reduces the size, weight, area by about 90 percent," Reedy says.

"More importantly for military and aerospace customers, the vast majority of reliability issues are at the package and board level; the stuff on the chip rarely breaks. By reducing the large number of components on the board, the reliability goes way up as weight, size, and cost come down."

As Peregrine engineers have pursued efforts to dramatically increase RF integration using sapphire substrates, they have begun to find support from some of the giants, including Intel, which has become a major investor.

MEMS

Not everyone, of course, agrees with Reedy, in terms of materials or even the overall status of integration technology. There is an understandable tendency to see the problem in terms of each company's solution.

For example, one developing technology many consider vital to future integration at this level is micro electro-mechanical systems (MEMS) switching, which allows not only integration but also remote reprogramming. If there is an integrated device in a satellite now, the user is stuck with the preset frequency. But with reprogrammable RF components using MEMS, that limitation would vanish.

"Integration hasn't moved forward in the past because no one has been able to integrate a switch because of the lifetime reliability of the switch," proclaims John Maciel, chief operating officer for Radant MEMS Inc. in Stow, Mass. "At this point, we've gone out to 100 billion cycles, which is a requirement for radar applications, and have a hermetic package at a relatively low cost, where our competitors have gone to a more expensive — in terms of handling and packaging — ceramic wafer."

Radant's approach is to bond two 6-inch silicon wafers — one with the switch, the other the cavity for proprietary RF microwave and analog integration. Another key to their approach is MEMS.

"With our sister company, Radant Technologies — which is being funded by AFRL (Air Force Research Lab) at Hanscom Air Force Base — we're delivering a MEMS-based passive electronically steerable antenna, one of the first large scale applications of MEMS in an antenna anywhere. It's a 2-by-2-foot aperture, X-band, employing about 25,000 MEMS switches per antenna," Maciel says. "It's very lightweight, low power consumption in a low-cost architecture. Our previous version employed pin diodes, which we're replacing with the MEMS.

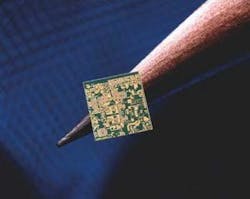

MMICs from Northrop Grumman can fit on the head of a pencil.

null

"The advantage of MEMS is twofold — the prime power to control the pin diodes is reduced by about three orders of magnitude, with a lower insertion loss and increased gain," he explains. "The bottom line is these kinds of platforms have a significant reduction in prime power consumption."

For future applications, Radant is looking at MEMS-based switches in hermetically sealed chips that eliminate all wire bonding.

"The idea is to get the cost of phase shifters down to a point where they can be deployed in large volumes," Maciel says. "We're looking to get down into the $10 price range, compared to $100 using a conventional pin diode-based phase shifter. In addition, the insertion loss would be three times larger than MEMS-based. That is huge in a radar application.

"We expect to have our first switch product out in about six months," he adds. "That will be a discrete MEMS switch. The antenna product also should be ready in about six months. A typical phase shifter design is a bit further out; we're just starting to ramp up on that."

COTS

Then again, perhaps the problem is neither substrates nor switches nor MEMS, but tighter government budgets stemming from an over-reliance on commercial-off-the-shelf solutions. At least, that is the theory espoused by Richard Szwec, chief principle engineer at ITT Gilfillan Microelectronics Center (MEC) in Roanoke, Va., who blames it, in part, on a "digital mentality."

"The government seems to believe even special requirements should be priced at a COTS (commercial-off-the-shelf) level. The problem is, special technologies still require substantial development," Szwec says. "We're using off-the-shelf circuitry, but it's not extremely efficient. The vendors are making the parts to fit a number of different customers with specific applications. As a result, they are larger in size. To do the job correctly would be cost prohibitive.

"The COTS concept from digital has filtered its way into the microwave arena. You can do it, but it isn't efficient," he explains. "As far as gallium arsenide (GaAs) or any microwave component is concerned, there isn't enough money to develop it because you don't have as much demand in radar systems as you have for digital in cellphones and such. There isn't the money to have a company develop a specific chipset; the margins aren't high enough, the quantities aren't high enough."

The result has been doing the best possible job with what is available as chip manufacturers eschew the investment required to develop next-generation chips and the military chafes at systems that fail to meet their performance expectations. Instead of alleviating that by supporting new technology development, about five years ago the government began to see COTS as the best answer. More recently, available funding has gone to replenish depleted munitions stocks after Iraq and Afghanistan and to speed up transforming the military into a more agile force.

In some respects, however, that is a bit of a Catch 22, as agility requires the smaller, lighter, more reliable RF elements COTS cannot support. And while the commercial market has an incentive to develop next-generation components to meet large-scale requirements, companies cannot afford niche development.

"A company like ITT that may want to develop a new system has to do it internally, where there are competing needs. That may preclude developing both a better processing system and a better, next-generation chipset at the same time," Szwec says. "The overall defense budget has increased, but it isn't filtering down.

"And MEC doesn't have small business funding advantages because we are part of a larger corporation," he continues. "There are a lot of opportunities out there, but until government funding issues recognize the small divisions of large corporations can contribute, it won't impact the MMIC (monolithic microwave integrated circuit) world."

Getting back to whether a low-cost solution may be found in the substrate, Kyocera America Inc. in San Diego is promoting the integration of features or functions that otherwise would require separate substrates, wire bonds, resistors, etc., into the ceramic itself. New product development manager Arne Knudsen believes that, while it requires a sophisticated design involving a high level of materials understanding, the solution is building integration of as many discrete functions as possible into a smaller semiconductor package, especially for such applications as military radars.

"We have a family of ceramic materials, as well as metals, that can be adopted for a specific task. Aluminum nitride is a particularly thermally conductive ceramic," he says. "Our workhorse material is aluminum oxide, which offers a unique blend of high mechanical strength, electric performance, and good bonding to metals such as heat sinks or connectors. A third type of material is low-temperature co-fired ceramic, which is somewhat inferior mechanically and more costly to procure, but offers very attractive electrical advantages, so for very high frequency modules, such as K-band or higher, we might adopt LTCC as the substrate. These materials also are all space-qualified and, generally, can be manufactured in such a way as to be hermetically sealed."

Although it's the major supplier of sapphire for Peregrine's substrates, Kyocera prefers their packaging solution for integration to meet the overall requirements of the customer community. Some of the critical elements in that design include:

- size — often dictated by the wavelength of the RF;

- electrical performance — balancing insertion loss (energy transmitted) and return loss (energy reflected), along with isolation;

- thermal — such chips typically operate at fairly high power, requiring an understanding of thermal dissipation to control and distribute it;

- mechanical — understanding the capabilities of the materials;

- cost — the more sophisticated the integration, the more costly; and

- environmental — do they need to be hermetic or not, do they need to be radiation hardened, etc.

"Some procurement cycles are very long," Knudsen says. "In order to see integrated packages in projects now in production, they would have had to be there five or ten years ago. This kind of integration is also, in some ways, against some of the directives our customers have to simplify or use COTS or go to lower cost. One thing we have had to do is educate our customers that, while the integrated module itself may be expensive, the overall system cost may be significantly less as a result, after you take into account additional components, assembly and so on.

"Doing these kinds of highly integrated packages is also very time-consuming. We worked on the JSF/F-22 radar module for seven years before it went into production. And neither platform is actually in production yet, although constructing the radar precedes actual delivery of the aircraft by a couple of years."

One thing everyone agrees on — the future is almost certain to bring more sophisticated RF requirements and further requirements to integrate. In some areas, that may lead to a migration away from analog to more digital designs to meet a continued, fundamental drive to lower costs.

There is another Catch 22 in the effort to integrate more functions into these modules. Because of the low quantities, whichever solution is used tends to be developed for a specific customer — and thus becomes proprietary. Without a standard module design that can be applied across the board, companies such as Peregrine, Kyocera, ITT, and Radant must approach each new prospect by first educating the customer on what can be done, often without being able to show or even fully describe what already has been done.

And, of course, with unique solutions come significant development costs if the goal is to move from discrete to integrated components in such an environment. That also means looking very closely at trade-offs, at how much integration may be too much integration.

"It's not always clear the maximum degree of integration is the right approach, but any given set of requirements may drive you to more depths of integration than currently are on the market," says Bob Lukachinski, director of RF and microwave products business development for EDO Electronics Systems Group in Deer Park, N.Y.

"If you want to design a discrete amplifier or use multiple MMICs, the first answer today may be to find what's available in COTS," Lukachinski says. "If integration was commercialized and meets your performance requirements, then it will be more cost effective. But if you are looking at a custom MMIC, the non-recurring costs (NRC) will not be insignificant. There are some applications where you still go for the custom device that gives you the best performance, but many of the designs we do don't have sufficient demand to warrant the development costs."

For example, while it might be possible to put an entire receiver channel on a chip, it will not be a COTS MMIC. So what is technically possible may be realistic only with a combination of size, weight, and power drivers with available NRC funding. If more funding becomes available then higher levels of integration will be possible.

A common approach is to buy an amplifier and put it in front of the mixer, but there has been a recent trend toward integration, which saves losses and transitions, as well as space and added heat. Simply put, however, the military is looking for more and more controls in a smaller space, which means increasing requirements for integration.

"This level of integration requires different kinds of expertise to work together, which makes it more complicated to manufacture," warns Jay Chudasama, director of broadband RF/microwave products for Aeroflex in Plainview, N.Y. "You also need much better thermal management. Another challenge is that integrated components are much closer together, which requires a higher level of automation in the manufacturing process. So there is an upfront investment for tooling and fixtures, but the long-term cost is less per piece because of reduced labor and fewer parts.

"The biggest challenge in integration, in the high frequency arena, is crosstalk leaking into the RF cavity. If you have a high gain amp, with the other components very close, you have to make provisions to shield it, which is more challenging from a design point of view."

Weighing the tradeoffs is a constant exercise in integration, where the leading driver is a serious size requirement. Smaller size also offers major advantages in performance by controlling the transition from one device to the next with less loss. That also avoids the problem of rarely being able to precisely match connectorized components. In the RF world, integration also allows for shorter bond wires between components, further improving performance.

"One technology that is taking integration to the next level is multilevel," Chudasama says. "Instead of having components horizontal or vertical, you can place components between layers, which also is a size-saver. Inductors can be placed between layers instead of on top, for example."

"We use solid filled vias (chemically 'drilled' holes) on the substrate for heat dissipation, moving it from the die on top through the bottom to the housing. We use the same technique to cut down on crosstalk. These are basically round holes in the substrate filled with grounding material, such as copper, gold, or combinations. By controlling the grounding, we can separate the crosstalk of nearby components."

Lukachinski says he believes integration will always be a matter of compromise, perhaps with respect to power-added efficiency, perhaps to mine the next tenth of a decibel (dB) of noise figure (the contribution the device itself makes to thermal noise at its output over the bandwidth of interest).

"In the right domain, a discrete set design with a customized substrate will give you an absolute optimum capability of performance in the microwave region — probably better than a commercially developed MMIC," he says. But if you don't need that last tenth, you'll move toward (the lower cost) MMICs.

"Another relative trade space is frequency," Lukachinski continues. "We tend to work in X-band and above. At those millimeter wave bands, the physical spacing of devices becomes so critical that, at that point, MMICs may give you the better performance. You also won't see a lot of commercially developed MMICs in that domain. One reason multi-chip modules come into play is because at some point you will pass a cost-effective breakpoint in the yield of die off the wafers. You've integrated so much value into each die that yield will start to drive the cost of those devices beyond economic value."

A decade ago, designers would have looked at a hybrid approach; today, it is multi-chip modules that allow design to be consolidated with ever-improving performance rather than relying on heavily connectorized components or packaged devices. The critical process of keeping the devices as close together as possible as frequency increases also is constantly improving. Die thickness is shrinking, so the thermal path out of the junctions is becoming smaller, better conductive substrates are enabling better thermal management and so on. Even so, each application still must balance all of the design tradeoffs, especially when integration is part of the equation.

"You want to guarantee performance. Quartz or sapphire substrates are used only when you are required to meet the most demanding performance requirements, either for thermal management or state-of-the-art noise figure," Lukachinski says. "When you are making these trades at the component or integrated assembly level, you are making them with regard to a specification and the customer usually is involved in a higher level optimization. If it is an integrated link, where at the system level you are playing noise figure against transmit power, you need to work together with the customer to make sure the best possible trades are being made.

"Many times, when customers place very demanding requirements, they are looking for proper identification of the drivers and alternatives at the system level that will allow them to get a better system design with lower recurring costs," he explains. "There is a capability to invest non-recurring to reduce production cost. If you drive performance to state-of-the-art, you may drive both elements. I've never known a system engineer who didn't want margin in his back pocket."

In the digital COTS mindset that has driven government design and procurement policy in recent years, the military has tried to address the lower volume problem by accepting COTS designs into the MILSPEC environment. What has not always kept pace in parallel is what is being demanded from the ultimate product. It is not enough to simply accept COTS into the solution; the real test is whether COTS can properly — or even adequately — accommodate the required military performance domain.

"At a more macro level, we may have to address a somewhat lesser platform capability that is more than offset by the reduced development and production costs that could call for more of them. You may need only three copies of 'The Ultimate Support Platform' — but can't afford to build even one — where by reducing the performance requirement you may need 50 platforms to accomplish the same goal, but they come at a cost level that can be met," Lukachinski suggests. "That is an infinitely more complex trade space at the macro level than at the micro level because of the logistics chain — spares and repairs and such. We are making progress; most customers today are almost always willing to work with a good compromise solution to meet the endline objective. In fact, it's rare not to see a best value solicitation today. The true art of a device proposal is to understand that what your limitations will impose on the system designer is key to proposing the right degree of tailoring to capture the most value."

Northrop Grumman Defensive Systems Division in Rolling Meadows, Ill., is somewhat unusual in that it is both a user and a manufacturer of integrated microwave assemblies, using them as RF conversion assemblies, amplifiers and preselector modules in various portions of RF systems. In that process, they use a variety of different materials, although the majority has a standard aluminum substrate and packaging.

"Virtually everything we do does not lend itself well to off-the-shelf hardware," engineering director Mark Feldman explains. "Integrated modules basically are built to order to meet a specific application, so there are very few standard products that could be highly integrated. For many years the military has been using integrated custom modules."

Northrop Grumman hardware development manager Dan Blase says some of their highly integrated specialty modules contain more than 100 MMIC and ASIC (application-specific integrated circuit) devices in a 3–6-inch module, replacing a box full of discrete components and connectors.

"Heat dissipation is an inherent problem at that level of integration. Our mechanical engineering staff uses a lot of tricks of the trade to deal with it, including aluminum case frames," he says. "We try to avoid sapphire because of cost issues; other materials have handling hazards. But there are times when the constraints of heat dissipation or performance require more exotic materials, so we do use them on a limited basis."

Another recent military program to incorporate fully integrated MMICs is the AH-64D Apache Longbow attack helicopter. Rich Beeber, marketing director for Crane Aerospace Electronics subsidiary STC Microwave Solutions in Phoenix, Ariz., says the Longbow's transceiver and seeker represent one of the highest volume applications to date.

"The first new platform that might have that level is Common Missile (a tube-launched, optically-tracked, wire-guided replacement for the TOW and Hellfire missile systems). And everybody is chasing that," he says. "You don't really need MMICs, per se, unless the specific application is driven by size. On JSF, they are looking at an order of magnitude improvement in size and weight, so you will see a much higher level of integration. But we're just now starting to see specs on that program funneling out into industry."

Common Missile will have one millimeter-wave seeker and some onboard electronics, all highly integrated. JSF will have much more to handle radar, navigation, and other electronic applications. The performance requirements for both will mean higher levels of integration because the interconnections required by discrete parts would be unacceptable.

"The whole problem in this business has not been the chips but the packaging. Those two programs will drive a whole new technology set in packaging," Beeber says. "I think you'll see advanced composite materials. In Philadelphia (at the 2003 International Microwave Symposium in June), you saw 500 companies with machined housing. That won't happen in the future. People are looking for lightweight composite materials with unique thermals to allow them to put it all together. We have kicked off an IR&D program to do exactly that — develop better packaging."

Founded in November 2000, Inphi Corp. in Westlake Village, Calif., started out in optical communications, then recently began adding RF microwave products. Technology VP Loi Nguyen says they are looking to bring new technology to an often skeptical marketplace — and take customers away from established players — by showing important advances in cost, quality, deliverability, and performance. Where previously the microwave community only had limited technologies, either low frequency or hard to manufacture and integrate, Inphi is offering more advanced alternatives, he says — indium phosphide (InP) Heterojunction Bipolar Transistors (HBTs).

HBTs were first developed in the late 1940s, but serious work — incorporating GaAs — did not begin until the 1980s. Today it is a mainstream for RF and microwave devices, found in more than half of all cellphone power amplifiers. Nguyen describes GaAs HBT as being highly manufacturable and low cost with high integration — three critical elements making it a success in a cost-competitive market.

"We're taking that technology to the next level," Nguyen says.