Defense and homeland-security users of RF/microwave products have demanding and unique needs that the commercial market can fulfill only rarely, which shines the spotlight on this sometimes-problematic area of a U.S. military that is starved for research and development money.

By J.R. Wilson

Not all technologies are destined to evolve to a higher order — not because no one wants them, but because those who do cannot afford the necessary research, and represent too small a market for industry to make the investment. Such is the case today for the future integration of radio frequency (RF) and microwave components and subsystems, whose primary user is the military.

RF/microwave, nevertheless, has a bright future, and may well benefit from the further evolution of commercial products, including digital. RF refers to radio frequencies lower than 1 gigahertz, and microwave refers to radio frequencies from 1 gigahertz to 300 gigahertz.

On many levels, RF/microwave today compares to digital's level of integration a quarter century or so ago — essentially a lot of large (by current standards) components bunched together. Digital, however, has been on a seemingly unstoppable evolution toward ever-smaller, less-costly, and more- tightly integrated components, driven largely by the demands of consumer electronics such as cell phones, pocket-sized GPS devices, digital cameras, and even hearing aides. The same is not true for RF/microwave.

The future Advanced EHF (AEHF) military strategic and tactical relay satellite system, shown above, will deliver survivable, protected communications to U.S. forces and selected allies worldwide. This platform will use some of the most advanced and unique RF and microwave components yet designed.

"The level of integration at this point in time is fairly low," says Jim Komiak, an engineering fellow in microwave electronics at BAE Systems Information and Electronic Systems Integration in Nashua, N.H. "You do find multifunction circuits where you might be doing amp switching or phase and amp control, but that's about the extent of it. Very rarely do you find where things will eventually drive to, which is some sort of level of convergence between the RF/microwave circuits, the A-D/D-A digital control, and even some high-speed digital signal processing (DSP).

"I believe it will never get to system of systems (SoS), which is where the digital world is attempting to reach, but will always be somewhere in-between, relying on heterogeneous integration to optimize functionality," Komiak says. "The natural partition there is the front-end stuff, perhaps with some optoelectronics thrown in to leverage. Depending on the application, these things will be complementary higher-end digital and lower-end RF/ microwave. Now, the commercial world can drive to SoS because they often are totally cost driven and will accept a given performance at a lower cost. In the case of RF/microwave, it has been government programs that have financed progress in the mil-aero arena, where cost is important, but so is performance."

Much of digital's success links to the continuing evolution of the computer chip, which is still following Moore's Law — the notion first espoused in the late 1960s that the number of transistors on a chip doubles every 18 months, essentially doubling processor speed every 18 to 24 months. While that also has aided RF/microwave, applications, requirements for these types of analog circuitry have not been as complex, as far as tight integration at the digital level is concerned, says Henry Chang, marketing director for the Mentor Graphics Analog Mixed Signal Division in San Jose, Calif.

No mirror of digital evolution

"While some people could promote single-chip RF system-on-a-chip (SoC), others don't believe one chip is the solution and are promoting a two-chip or system-in-a-package (three chips) approach, which is where most programs seem to be going," he explains. "From a vendor's perspective, it is obvious the interaction between the RF portion and the digital portion has increased a lot. That means whether it is one chip or two, the interaction is getting more and more complex.

Radar experts aboard the U.S. Air Force E-8 Joint Surveillance Target Attack Radar System, otherwise known as Joint STARS, depend on advanced RF and microwave components that are not always available on the commercial market.

"Our solution is to find ways to validate the whole system," Chang says. "We are concerned about the interaction between RF and the Base 10 signal, for example, and believe it will be getting more complex. In the past, the solution was to try to do it piece by piece. Another tool is available to handle the Base 10 digital circuit and Base 10 RF signal, but no technology exists that can handle all three cases together — RF front end, digital Base 10, and analog Base 10. Over the next five to 10 years, the design of RF front end and Base 10 signal circuit need to go hand-in-hand. Those two will be much more tightly integrated, but that doesn't mean it has to go into one chip; instead, you will have two chips inside one physical package."

Putting the RF and digital signal together would create a lot of noise and coupling effects that would result in more problems than benefits, he adds. As a result, using a two-chip/one-package approach would actually simplify the design. It also would not hurt size requirements, because the packaging for a single chip and a two-chip combination is about the same.

The two modes also differ significantly in composition. Where transistor devices dominate digital technology, the dominant factor in RF/microwave is matching circuits.

RF/microwave design tools

"That's where the tools come into it," Komiak says. "You have two sets of tools RF/microwave-oriented and digital-oriented. The RF/microwave tools are set up to handle a limited number of transistors, manual layout, and high-frequency models. The digital tools are basically large numbers of transistors, auto layout and routing, and very limited high-frequency models. For microwave tools, it is frequency domain, based on harmonic balance and admittance nodes, where digital is time domain."

Chang says the lack of a big push for integration does not reflect a future lack of demand for RF/microwave applications, especially as frequency demands rise into areas best handled by RF. The bigger question, he adds, is whether demand will be large enough to support small companies that are making significant investments in RF design, as well as large companies that can devote resources to a system-wide solution rather than the single-element focus typical of smaller firms.

One solution that has worked in other areas, such as cell phones, he says, is the system-integrator approach, using elements from several small companies that work toward a specification put out by the ultimate user. To accomplish that successfully requires a set of simulation and design-verification tools, but not chip-integration tools of the kind common to digital. Two years ago, for example, Mentor Graphics announced such a toolset for the design, simulation, layout, verification, and extraction of analog/mixed-signal SoC designs, including enhancements to ADVance MS (single-kernel simulator for analog, digital, transistor-level and RF simulation).

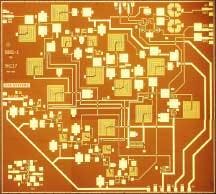

The BAE Systems' Return To Zero chip performs direct digital to X-band microwave up-conversion. It represents the state of the art in level of complexity and multifunction capability.

At Agilent Technology in Santa Rosa, Calif., John Stratton, aerospace defense programs director, says the demand for continual improvements in digital, coupled with a scarcity of funding for RF/microwave evolution, has sent the majority of engineering talent to the digital and related component labs, which in turn has helped keep Moore's Law alive. As a result, it can take twice as long — as long as three years — to see comparable increases in RF performance and closer to eight years for microwave.

"Today the problem is cost and how many companies are working on it," Stratton says. "Most commercial products are below 6 gigahertz, although there is some effort to move up to 10 gigahertz. While that is around the frequency range of a lot of X-band radars, it is a very narrow band and of little interest to the military. In future years, as that gets more attention, some new technologies and levels of integration may become available, but, again, it will be relying on commercial research.

"How that is developed and used may involve some of the same processes as digital, but to get to digital at that bandwidth, you need data converters," Stratton says. "Today an A-D converter, which is a very typical application, uses only about 6 gigahertz, which is great for wireless LAN, but to get to microwave you would need one more stage of down conversion before getting into the bandwidth of an A-D converter and down converters are analog, not digital. So while we're moving in the right direction, it is still a long way off before we can go directly from a microwave signal to a digital output, where digital signal processing (DSP) can take over and take advantage of all the things the commercial industry is providing."

Ironically, he adds, this is a case where commercial success may actually be detrimental to military requirements and systems.

Commercial drawbacks

"The military is aware of this and is trying to move everything to a higher level because as commercial technology evolves, it becomes available to potential adversaries, so the evolution is actually driving the military to stay farther away from it," Stratton says. "The military also has to be smarter about how they encrypt their data because they know a potential enemy can now see the transmission, but it isn't a threat unless they can decode it. So encryption algorithms will become more and more complex, which is better for everybody because they can then use lower-cost technology and still get the security they need."

In the long run, a military starved of research-and-development funding is best served by isolating those parts it knows the commercial markets will push forward from those they will not, such as RF/microwave.

This Northrop Grumman high-power solid-state amplifier will boost signal strength on intersatellite links of the Department of Defense Advanced EHF communications satellite system.

"Things are changing quickly in the digital area and data converters, driven by commercial requirements, will be smaller and cheaper in the long term. But microwave doesn't change very often, so the more they can separate it from the digital and analog pieces, the easier it is to replace the base band that handles DSP without having to change the RF/microwave up-converter elements. Then you have a reliable system that will last a long time," Stratton says. "But if you put them all together, once one piece becomes obsolete, you have to replace the whole thing. It doesn't eliminate the military requirement, but it does manage it better. So as new systems are developed, they can take advantage of whatever technology is out there, but when they need to keep older systems operating, they can buy replacement pieces more easily."

As frequencies continue to creep up because the density of available spectrum is increasing, he speculates, commercial technology will push in, driving costs down. This means the speed of integration for military RF/microwave will be dependent on the availability of commercial bandwidth.

In many ways, much of the future of military RF/microwave is a study in serendipity. Unable to support new requirements with oversized and increasingly outdated technologies, the need for smaller components forces a significant change in designs. Instead of having one large transmitter, for example, a phased-array radar may have a thousand small, relatively low-power components.

Lower power opens the door to an all-solid-state DSP-based design with far higher reliability than vacuum tubes, which are still used in some high-power transmitters. To reconstruct the waveform, however, requires a great deal of DSP horsepower. This approach requires a higher level of integration, which in turn allows designers to dispense with a single large dish, instead scattering small elements along a wing, for example, with DSP then reconstructing their signals to mimic a dish. The end result is an increased capability that does not conflict with the stealth design requirements of new fighter aircraft.

"The advances are not taking place in RF/microwave integration in radios, but in baseband and DSP, which are driven by the communications industry. As a result, you get higher reliability and lower-cost military communications and weapons systems. It also gives the engineer more flexibility in how to design the system, looking at things from different perspectives that would not be possible without high-speed DSP," Stratton says, adding the forces behind such developments are more likely to impact RF than microwave.

The Raytheon Digital Airport Surveillance Radar/ASR-11, shown above, will provide key traffic services at U.S. Department of Defense and Federal Aviation Administration airports into the next century.

"As soldiers carry more and more communications capability, for example, the more need there will be for small, compact radio systems. But those communications will be more in RF than microwave, primarily because RF doesn't need line-of-sight, where microwave normally does. There are lots of commercial technologies using RF and that's where they probably will see the advantage. Most microwave components do not have those kinds of size requirements; the largest consumer customers for microwave are in ultrawide bandwidth, around 10 megahertz. Anything above that is largely collision-avoidance radars. As a result, there are very few people doing the microwave side, compared to a lot working on digital and low- frequency analog."

RF/microwave integration

While chip size and function tend to characterize such advances, the glue holding them together is the interconnects, which also are likely to be increasingly important to the future of military RF/microwave applications.

"Interconnects are what really drove the advancements in the digital market," argues Nick Colella, senior vice president-operations at Tessera Technologies in San Jose, Calif. "Remember how difficult it was when they were trying to mix logic and memory on the same chip? Instead, some companies specialized in memory technology and others in logic. That kind of segmentation allowed the creation of good business relationships with other companies providing design tools, testing, and other supporting infrastructure. At the same time, standardization on logic and memory devices and a general scale-up allowed designers to begin thinking about them as commodities. That, in turn, brought in materials venders and equipment for manufacturing and testing.

Increasing complexity of unique RF and microwave components and subsystems for military applications is placing big demands on test and measurement equipment such as the Agilent E8364A vector network analyzer, pictured above.

"The difference I see between digital's success and RF today is in silicon, which is cheap; you can have generic silicon FPGAs (field-programmable gate arrays), general-purpose processors, etc., that allow you to do a lot of sophisticated information processing with software," Colella says. "So if there were deficiencies in system performance, you could make those up with software, such as forward error correction. We also see the passes can be somewhat sloppy, working with relatively poor tolerances compared to RF. Also, with short production cycles, people can plan digital evolutions to get money out of the business and have clear roadmaps going forward."

Craig Mitchell, Tessera marketing vice president, says the same is unlikely to be the case with RF, even less so with microwave.

"I have challenged some folks on whether there is a meaningful road for an RF FPGA, analogous to a digital FPGA," he says. "The answer is probably not in terms of a commodities product. If you are going to do microwave radar systems, you will come back to very customized solutions. In terms of RF handheld devices and higher markets, you are using it in a sensitive way to send and receive signals, but in terms of information, you want as much of that as possible handled by digital electronics and software. So there doesn't seem to be a prospect for having generic gallium arsenide (GaAs) or silicon germanium (SiGe) in the RF domain such as there is in the digital domain.

Mitchell notes that, for Tessera, rather than being able to apply their digital integration experience to RF integration, "we're finding our experience with RF is preparing us for continued integration on the digital side." That is an outgrowth of dealing with the environmental sensitivities high-speed analog signals have at the interconnect and couplings level, foreshadowing issues they expect to confront in high-speed digital circuits one or two generations into the future.

Package or chip level?

Colella's view of the future of RF/microwave integration agrees with Chang's — integration will occur at the package, not the chip, level.

"I see a lot of significant progress coming on packaging, how to model the interconnects between chips and mode parasitics. I think there will be rapid improvement in modeling and simulation, especially below 5 gigahertz, because as digital circuit speeds go up, a lot of them are confronting a number of issues that RF and analog designers have been agonizing over. So there will be a general increase in the brain mass of people working on such effects as ground plane noise. Then there will be a general motivation on product engineering to examine these issues on design tools that will indirectly benefit RF and RF design," he says.

"My gut tells me, in the case of commercial products, RF circuits will be specialized more toward the physical level; how to send a signal across the air in a very clean and cost-efficient way."

The same market forces that have spurred digital and restrained RF/microwave integration also are at work in the development of design, test, and development tools.

"For digital applications, there is a whole cottage industry of test sockets," Colella says. "Big companies emerged, with standards evolving for a segmented market, so if you are making a test socket for a new DRAM for Samsung, you can align your roadmap to their product release. The RF industry is so fragmented and niche-like that a lot of that development infrastructure is impeded; it is very hard for any one design company to essential bet their future. So a company making an RF system for the military has to develop custom test fixtures that are not picked up by others. The digital world also has wonderfully short cycles, where the RF and microwave realm has much, much slower development cycles."

Two concurrent events led to the rapid development of digital: telecommunications reform that turned spectrum into a revenue-generating asset and the decline of the defense industry, which fell just as hard and fast in the 1990s as it had grown in the 1980s. While no such reversal of effort is expected for RF/microwave in the next decade, the continued evolution of digital may itself bring those same engineers and their successors full circle.

"As noise and couplings become more problematic for digital circuits, it will benefit RF design and modeling tools because there will be a need there," Colella predicts. "You may have a wonderful, screaming, high-performance chip, but standing between it and the rest of the world is an interconnect that is not being properly modeled. So as problems arise in the digital arena, industry will start tapping into the experience of RF engineers, confronting problems they have solved in the past. At that interface between digital design knowledge and state-of-the-art RF-circuit design knowledge, it will be a very fertile place for new design tools and for people to work with mixed signals and design circuits.

"It's almost a forced convergence," Colella says. "Digital has one approach to the problem space, RF another, and it will be the collision and hybridization between those two approaches that accelerates the development design tools for both. It also will move RF away from being analogous to high-performance backplane engineering to more of a product-based approach typical of digital."

The 5- to 10-gigahertz range

There is an anticipated blurring of circuit design issues for RF and digital between 5 and 10 gigahertz, creating new types of jobs requiring new design tools and a new understanding of both arenas. Thus, the continued evolution of digital design tools to meet new challenges in the next 10 years may well induce a corresponding evolution of RF design tools.

"There has always been a trend to higher data rate, more bandwidth, even with the commercial stuff working its way up in frequency," notes Phil Smith, BAE's director for microwave devices and circuits. "Wideband is still below 10 gigahertz, but beyond that you have point-to-point data rates, automotive radar, and so on, but those really aren't a major demand and are still expensive. So unless there is a breakthrough, like cell phones, but at high frequency, DOD won't benefit. It is happening, but in a very controlled way, not in the rapid way of the cell-phone explosion.

"We understand the military has needs and the demand there is for faster, lighter, more mobile, more capability, network centric, all of which will drive the technology," Smith says. "And improvements will be made. It just won't occur at the rate it would if a big commercial activity were driving it."

Nonetheless, Mitchell maintains, there are significant opportunities for innovation in RF/microwave.

"We need to start realizing the importance of that system between the chips, which will be key to integration, not just at the digital or RF level, but at the product level, and will fuel product evolution and innovation," says Mitchell. "It will allow for next-generation, more highly integrated products to be delivered to the consumer, military and medical markets."